RACIAL EQUITY THROUGH ENTREPRENEURSHIP

Wealth Building for Business Owners of Color: A Whole-Person Approach

By Cynthia Terry, Director of Entrepreneurship, Ines Polonius, CEO and Dr. Elaine Crutchfield, Director of Research & Program Support Services

“If you’re talking about growing Black-owned businesses and you’re not also talking Black wealth, you are missing the transformational community opportunity.”

Melvin J. Gravely, civic leader, CEO and author of Dear White Friend: The Realities of Race,

the Power of Relationships and our Path to Equity.

Communities Unlimited (CU) is a community development financial institution (CDFI) intent on participating in multiracial partnerships and coalitions. The following is the first of a series exploring racial equity and wealth building for business owners of color and what Communities Unlimited has learned from working side-by-side with entrepreneurs of color in the South over the last 24 years.

Historically over the past 24 years, our consultancy clients and our loan clients are predominately Black and Hispanic owners. Our entrepreneurs and small business owners of color that received CU’s consultancy services over the past 24 months, through the pandemic, have included the following.

In this series, Communities Unlimited is advancing the idea that by expanding existing technical assistance programming for business owners of color to be long-term capacity building that incorporates wealth creation strategies will help reduce the racial wealth gap for these business owners and their families. This means focusing on the business owner and improving their business management capacity, focusing on strategies that grow their business, and then also focusing on wealth creation strategies that increase that Black or Brown owner’s personal net worth.

Cynthia Terry, Director of Entrepreneurship, Communities Unlimited, explains: “We need to do more than celebrate a start-up’s survival to year five and beyond. If its year 5 and the business is making a profit and nothing else has changed for that entrepreneur of color – why not! Closing the wealth gap means that business has to increase that Black or Brown owner’s personal net worth.” Ms. Terry, herself a successful entrepreneur of color and owner of multiple businesses, introduces the concept of eWealth Health©2022, wealth building for entrepreneurs of color that is centered on the “whole person.”

eWealth Health©2022 transitions entrepreneurs from the traditional technical assistance focused on start-up, profit, and growth to an intentional goal of wealth creation – from the very start. Unlike tech-accelerators across the country that hope to engage entrepreneurs of color in developing high-profit products and services, CU’s approach is industry agnostic. We meet every entrepreneur where they are. The “Whole Person” approach, starts by meeting entrepreneurs where they are – creating the foundation upon which to build the capacity for wealth creation.

Changing the wealth gap in America requires a willingness to learn from those living on both sides of the gap and understand a few key insights distilled from decades of research.

- Recognize and accept that there IS a racial wealth gap.

- Successful business owners of color can reduce the racial wealth gap.

- There are strategies that will help entrepreneurs of color build wealth through business ownership.

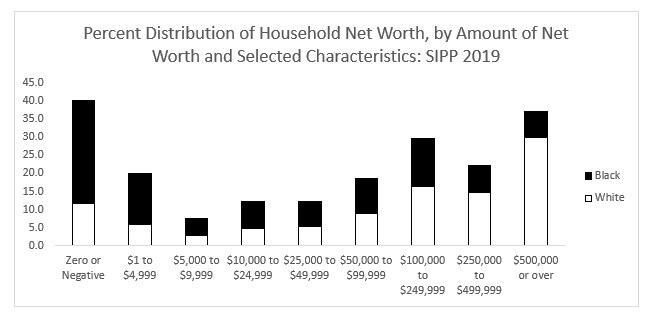

There is much research on the fact that there is a racial wealth gap. Wealth is a reflection of a system, in this discussion a family’s economic system where the value of the whole is not only a sum of the parts. Family or household wealth is influenced by the assets owned, the type of asset, in some cases the location of that asset (e.g. real estate), investments, savings, retirement accounts, among other things often acquired with income influenced by formal and informal education. The result is that today, Black households hold an average of 29 cents for every dollar of wealth held by white households (2019 SIPP)[I].

Successful Business Owners of Color Can Reduce the Racial Wealth Gap

Entrepreneurship is a key pathway to narrowing the racial wealth gap. Why? Black business owners have significantly more wealth than non-owner Black households; there is a long history of Black entrepreneurship in this nation; the over 2.5 million Black-owned businesses make valuable contributions to the national economy and create jobs.

The median net worth for white business owners was 3 times higher than for Black business owners, which – while still in need of significant improvement – is better than total white population wealth which is 13 times that of Black Americans. [xiii]

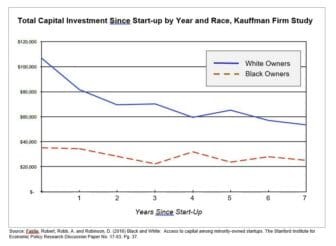

“When accounting for the racial wealth divide, the firms which use their own personal funds are drawing from lower wealth levels than their White counterparts. The unequal reliance on personal funds recreates wealth disparities, as minority firm owners drain their personal wealth while White owners expand theirs, as they are more financially capable to save their own personal funds and use their greater revenues to fund their businesses.”[xxii]

disparities, as minority firm owners drain their personal wealth while White owners expand theirs, as they are more financially capable to save their own personal funds and use their greater revenues to fund their businesses.”[xxii]

The chart (at right) illustrates how limited personal wealth, a key factor in access to capital, constrains investment in businesses comparing white and black owners.

The cycle of racial inequality repeats.

Founder net worth and lower levels of all major sources of funding are symptoms of a more complex and much larger issue as briefly illuminated above.

This aligns with the observations of Communities Unlimited leadership after much reflection on a quarter century of work with entrepreneurs, the majority of whom represent a racial or ethnic minority. How does Communities Unlimited know about Entrepreneurs of Color?

Communities Unlimited’s eWealth Health©2022 Initiative

For Communities Unlimited (CU), racial equity for entrepreneurs means developing an organizational culture and system of internal policies and practice that actually helps business owners of color start and grow a small business. CU has abandoned the norms of lending that undermine access to capital for business owners of color by turning traditional lending on its head. Relying on credit scores and collateral for loan decisions perpetuates barriers to capital for under-resourced entrepreneurs. Instead, CU de-risks supposedly “risky” loans through intensive technical assistance, helping the borrower determine exactly how much capital they need. This may seem a trivial issue—it is not. Many a business fails either by borrowing too little or too much. As a business meets or exceeds benchmark projections while making regular payments, follow-on loans meet the borrower’s growing capital needs.

For CU’s consultancy practice, racial equity for entrepreneurs means taking a whole-person approach to service delivery by identifying the inhibitors to the business growth and then developing a technical assistance plan that addresses those inhibitors. CU’s technical assistance plans are primarily one-on-one consulting engagements for 20 to 100 hours over weeks or several months helping strengthen business skills and business owner management capacity.

When a business client runs into an unexpected challenge, its CU consultant and technical assistance provider, who knows that business well, steps back in to assist the entrepreneur in problem-solving. For loan clients, this often includes having the lending team step back in to restructure the business loan to create cashflow relief while the CU consultant works alongside the owner to revisit the business model or analyze costs and expenses to adjust the business financial model. A key strategy is to look beyond business profitability to a “whole person” approach that focuses on key wealth building strategies including the well-planned sale and transition of businesses owned by people of color.

The targeted strategies vary depending on the entrepreneur, their family’s wealth, and the community in which they live. Key steps to helping all businesses thrive and build wealth include the following:

- Secure equity capital so as not to rely on credit cards that ruin credit scores before a business even gets on its feet.

- Develop strong financial and management systems to ensure the business becomes profitable.

- Innovate process and products to become and remain competitive – whether the entrepreneur is operating a business that provides essential quality of life in their community or building a high-tech product.

- Access capital to grow the business and purchase assets that appreciate and contribute to wealth-building.

- Secure trusted investment advice to set up 401Ks or IRAs [individual retirement accounts] that build wealth.

Communities Unlimited has developed a new eWealth Health©2022 initiative to addresses the socioeconomic inhibitors to small business growth and wealth building for business owners of color by taking a whole person approach to serving the business owner.

The “Whole Person” approach as coined by Cynthia Terry, starts by meeting entrepreneurs where they are, in the moment, building a relationship and earning trust. Consulting required a mindset-shift of “how do we accomplish” your goals and make certain you build wealth at the same time. The Whole Person approach also encompasses the foundation required for capacity development.

The next paper in the series will delve more deeply in the mindset-shift required by the consultants providing entrepreneurs of color with initial technical assistance.