capacity building for agricultural entrepreneurs

Small Farm Loans

What It Is

Small farmers are vital to communities but often struggle to access funding. Our Small Farm Lending program helps ease cash flow pressures caused by cost-reimbursement models.

Loans can be used for:

- Purchasing Equipment

- Inventory/Supplies

- Working Capital

- Contract Fulfillment

- Market Expansion

Let's Talk

Debra Leach

Area Director of Lending

Debra Leach

Debra Leach, Area Director of Lending, joined Communities Unlimited (CU) in May 2021.

She is responsible for originating quality loans through internal and external referral sources. She also develops strategies to market the bank’s SBA and small business grant programs to entrepreneurs with financing needs. She came to Communities Unlimited with a strong financial background, from her previous roles as a Vice President/Loan Manager for Arvest Bank as well as Vice President of Commercial lending for RCB Bank.

Debra has a BS in Business Administration, Marketing Management Orientation from Southwest Baptist University in Bolivar, Mo.

Phone:(405) 250-9316

Contact Us

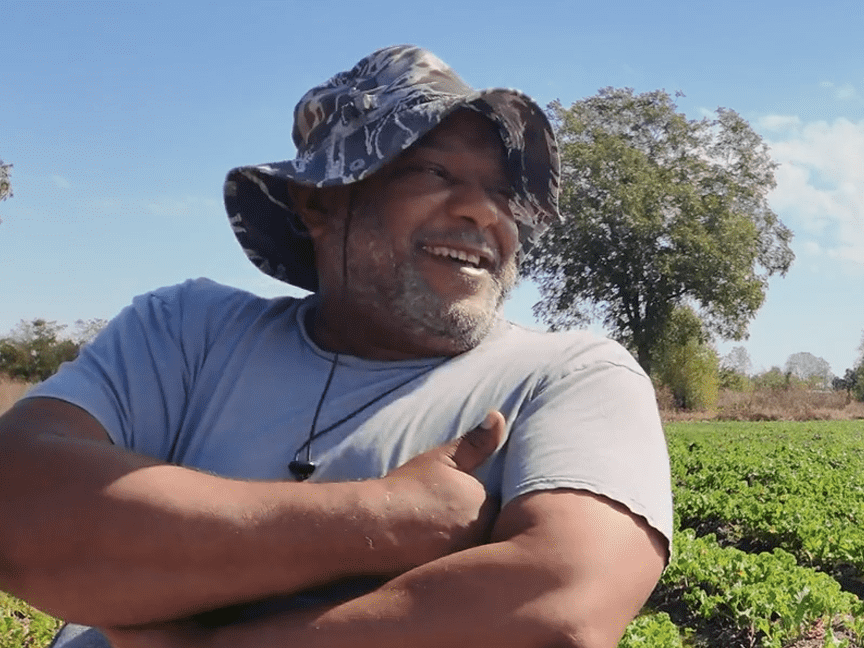

“I’d advise people to seek out organizations like Communities Unlimited because traditional banks aren’t friendly to small-scale farmers like us. If I had to do it over again, I’d have reached out to you all much sooner.”

— Ollie Cox, Owner, Mator Farms

Small farmers are the backbone of a community and access to necessary funding to operate their business is challenging. The small farming lending program at Communities Unlimited addresses the issue that small and micro farms face under a cost-reimbursement model where covering expenses upfront puts pressure on cash flow.

Whether it’s purchasing a new, upgraded piece of equipment or necessary cash flow to fulfill a new contract to expand into a new market, the small farm lending program allows small and micro farms to increase their capacity and meet demand.

Small and micro farmers deserve the support of flexible funding to ignite their capacity for success.

Requirements

- Completed Application

- 2 years business tax returns (if available)

- 2 years personal tax returns

- Year-To-Date financials (if available)

- Organizational documents

- Copy of identification

- Business checking account required

Details

- Competitive Interest Rates

- Up to 5-year term

- 1% Origination Fee

- 90 day interest only

- Access to capacity-building training opportunities

In accordance with federal law and U.S. Department of the Treasury policy, this institution is prohibited from discriminating based on race, color, national origin, sex, age, or disability. Submit a complaint of discrimination, by mail to U.S. Department of the Treasury, Office of Civil Rights and Equal Employment Opportunity , 1500 Pennsylvania Ave. N.W., Washington, D.C. 20220, (202) 622-1160 (phone), (202) 622-0367 (fax), or email crcomplaints@treasury.gov (email).

Reasonable Modifications for Individuals with Disabilities

Reasonable modifications may be requested by emailing info@communitiesu.org or calling (479) 443-2700, or persons with speech or hearing impairment may call toll-free 1-800-877-0996 for service in English and Spanish.