FINANCING SOLUTIONS FOR WATER & WASTEWATER PROJECTS IN RURAL COMMUNITIES

WATER & WASTEWATER LOANS

What it is

We offer flexible financing options—including interim financing, construction loans, equipment loans, and grant matching funds—that are designed to meet the unique needs of rural water and wastewater systems. By investing in essential infrastructure, we’re helping strengthen the foundation that allows rural communities and local economies to thrive.

Let's Talk

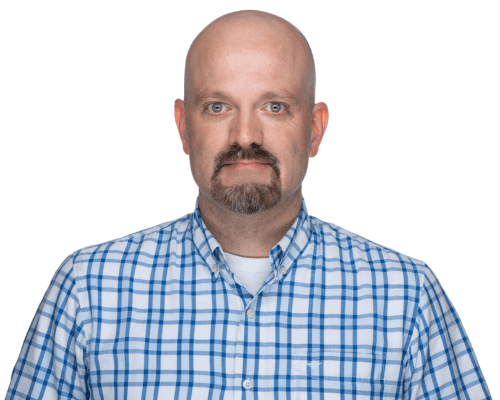

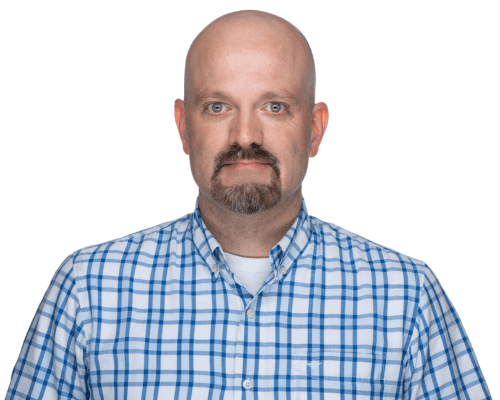

Chris Ranniger

Senior Economic Development Loan Officer

Chris Ranniger

Chris Ranniger is a Senior Economic Development Loan Officer for Communities Unlimited (CU). On top of commercial loans, Chris also handles CU’s infrastructure lending. He meets with borrowers to develop relationships, helps them get all accurate documents, and ensures they are properly prepared for the loan process. He guides clients through the loan process and works with the loan committee to ensure that everything is ready for loan closing.

Chris has a B.A. in Finance from Stephen F. Austin State University in Nacogdoches, Texas. Chris works out of CU’s East Texas office.

Phone:(936)404-4480

"Communities Unlimited provided the fastest, most helpful support we’ve ever had. They bent over backward to help us, and we’re very grateful.”

— Mayor Leanna West, Trent, TX

The Water & Wastewater Lending program plays a vital role in empowering small, rural communities by helping them meet compliance requirements for public drinking water and wastewater regulations.

This not only protects public health and improves system security, but also enables communities to expand services to new customers and enhance service quality for current users.

We offer flexible financing options—including interim financing, construction loans, equipment loans, and grant matching funds—that are designed to meet the unique needs of rural water and wastewater systems. By investing in essential infrastructure, we’re helping strengthen the foundation that allows rural communities and local economies to thrive.

Eligibility

Nonprofit corporations and local government entities may apply if you:

- Serve a significant amount of low-income customers

- Have a population less than 20,000

- Have the ability to repay the loan with system revenues

or

- have evidence of permanent take out financing and will accept no-cost technical assistance if it improves your ability to repay.

Program & Loan Terms

- Up to $750,000

- 1% Origination Fee

- Up to 15 year terms

In accordance with federal law and U.S. Department of the Treasury policy, this institution is prohibited from discriminating based on race, color, national origin, sex, age, or disability. Submit a complaint of discrimination, by mail to U.S. Department of the Treasury, Office of Civil Rights and Equal Employment Opportunity , 1500 Pennsylvania Ave. N.W., Washington, D.C. 20220, (202) 622-1160 (phone), (202) 622-0367 (fax), or email crcomplaints@treasury.gov (email).

Reasonable Modifications for Individuals with Disabilities

Reasonable modifications may be requested by emailing info@communitiesu.org or calling (479) 443-2700, or persons with speech or hearing impairment may call toll-free 1-800-877-0996 for service in English and Spanish.