Loans for construction, refurbishment, or replacing household water wells and septic systems

Well & Septic Loans

WHAT IT IS

Low-interest loans are available to assist homeowners with the construction, repair, or replacement of essential household water wells and septic systems ensuring access to safe, reliable water and sanitation.

LET'S TALK

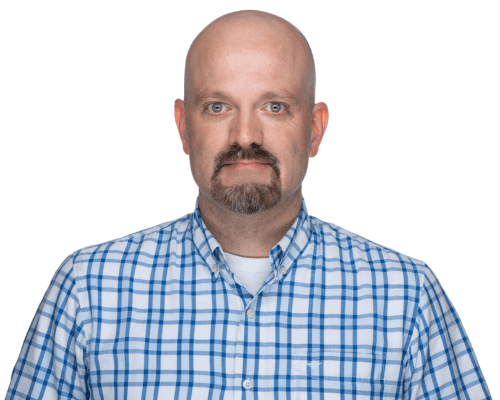

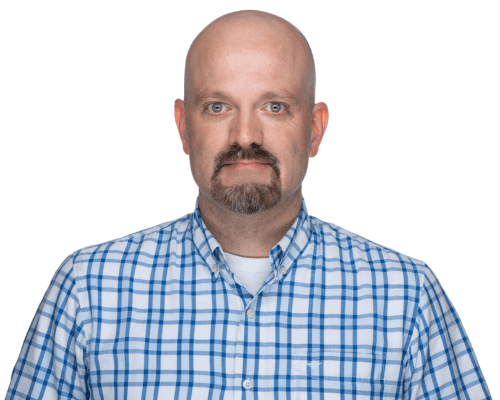

Chris Ranniger

Senior Economic Development Loan Officer

Chris Ranniger

Chris Ranniger is a Senior Economic Development Loan Officer for Communities Unlimited (CU). On top of commercial loans, Chris also handles CU’s infrastructure lending. He meets with borrowers to develop relationships, helps them get all accurate documents, and ensures they are properly prepared for the loan process. He guides clients through the loan process and works with the loan committee to ensure that everything is ready for loan closing.

Chris has a B.A. in Finance from Stephen F. Austin State University in Nacogdoches, Texas. Chris works out of CU’s East Texas office.

Phone:(936)404-4480

Funding for household water wells and individual septic systems up to $15,000.

1% fixed APR interest rate. Loan maturity up to 20 years.

Individuals in the Communities Unlimited and Midwest Assistance Program service areas are eligible to apply for the septic & well loan program.

Eligible states: Alabama, Arkansas, Iowa, Kansas, Louisiana, Minnesota, Mississippi, Missouri, Montana, Nebraska, North Dakota, Oklahoma, South Dakota, Tennessee, Texas, and Wyoming

Did you know?

Communities Unlimited offers no charge well assessments in Alabama, Arkansas, Louisiana, Mississippi, Oklahoma, Tennessee and Texas to homeowners. We will identify potential threats, sources of well contamination, visual inspection, and evaluate your water source. Interested? Find out more

Requirements

Residence must be located in a rural community with a population not exceeding 50,000

Cannot be used for new construction

Applicants must own and occupy, or be in the process of purchasing, the home being improved

Gross annual household income must not exceed 60% of the median non-metropolitan household income for the state

In accordance with federal law and U.S. Department of the Treasury policy, this institution is prohibited from discriminating based on race, color, national origin, sex, age, or disability. Submit a complaint of discrimination, by mail to U.S. Department of the Treasury, Office of Civil Rights and Equal Employment Opportunity , 1500 Pennsylvania Ave. N.W., Washington, D.C. 20220, (202) 622-1160 (phone), (202) 622-0367 (fax), or email crcomplaints@treasury.gov (email).

Reasonable Modifications for Individuals with Disabilities

Reasonable modifications may be requested by emailing info@communitiesu.org or calling (479) 443-2700, or persons with speech or hearing impairment may call toll-free 1-800-877-0996 for service in English and Spanish.