Accelerating small business growth and wealth building for entrepreneurs

ENtrepreneurship

At Communities Unlimited, we are dedicated to empowering small businesses to thrive. Here’s why you should choose us:

- Expertise: Our team consists of seasoned professionals with extensive experience in various industries.

- Personalized Support: We tailor our services to meet the unique needs of each business.

- Proven Success: We have a track record of helping businesses achieve their goals and grow sustainably.

- Value Creation: We focus on creating business value that leads to long-term wealth creation and sustainability.

Our 1-on-1 consulting approach ensure you receive the personalized attention your business deserves:

- Initial Assessment: We start with a comprehensive assessment to understand tour business needs and goals.

- Customized Plan: Based on the assessment, we develop a customized action plan tailored to your specific situation. Customized plan based upon a business’s financial.

- Ongoing Support: We provide continuous support and guidance to help you implement the plan and overcome challenges.

- Results-Driven: Our focus is on delivering measurable results that contribute to your business’s long-term success.

We offer a range of services designed to support your business at every stage:

- Financial Management: Expert advice on managing finances and improving profitability and to outpace industry standards.

- Capital Readiness: Preparing your business to secure the necessary capital for growth and expansion.

- Contract Readiness: Ensuring your business is prepared to meet the requirements for securing and fulfilling contracts.

- Business Planning: Business and strategic plans to guide your growth and development.

- Marketing Strategies: Developing strategies to enhance your brand presence and drive customer engagement.

- Training & Workshops: Educational programs to build skills and knowledge for you and your team.

E-Wealth Health

Entrepreneurship is more than a business plan. It’s more than a job. We see entrepreneurship as a vehicle to build a better life. Our E-Wealth Health program is uniquely designed to reduce the wealth gap and utilize your business to reduce the wealth gap and build generational wealth. But, don’t take it just from us, have a listen to what our clients say.

We know that running a business is hard work. Our management consultants conduct a thorough assessment with you for development of a comprehensive plan addressing the actual needs of the business and the capacity building needs of the business owner. Then, we implement the plan alongside the business owner.

Building capacity of small business owners to help them close the wealth gap

Working alongside small businesses to problem-solve issues and help them grow

Developing a holistic workplan based on the stage of your business lifecycle

"Communities Unlimited has provided my wife and me the opportunity to grow ourselves...They taught us how to put a business model together, structure ourselves appropriately, make sure our books are in order."

— Doshon Johnson, Urban Heights Investments, LLC

“Communities Unlimited not only was there to help with the loan process, but also to teach me how to do financial statements and balance sheets and just some of the things I needed to do more on the financial and banking side.”

— Anna Lisa Ramos, Cocina On The Go

Entrepreneurship Stories

From Purity to Profit

When Alyssa Davis opened Pure Hydration Plus in Beaumont, Texas, it wasn’t just about starting a business — it was…

Tuning Up for Growth

A year and a half after launching his business, Scott Anthony is already bumping up against the limits of what one…

Planting Seeds of Hope

At just 15 years old, Quinn Childress was living on Willow Street in Fayetteville, Arkansas, after being kicked out of…

Curated and Confident

When Ashley Gallon planned her own wedding in just six months — stress-free and fully designed by her —…

Smart Surge

Since partnering with Communities Unlimited (CU), Brittany Scott, founder of SMART Reproduction in Jonesboro, Arkansas,…

Thrive or Struggle

In today’s ever-evolving business landscape, running a small business can feel like an endless juggling act. Between…

Leveled Up

Davis Vernon came from humble beginnings. Growing up, he didn’t have much, but when he was finally able to save enough…

Building a Community of Gamers

In the rural town of Gosnell, Arkansas — located in Mississippi County near the northeastern corner of the state, just…

Handles, Heritage, and Hope

History & HickoryIn Demopolis, a town in west-central Alabama’s Marengo County, located in the Black Belt region,…

Owning the Glow-Up

In July 2023, Jasmine Wright opened Livi Facial & Beauty Spa in Conway, Arkansas. A licensed esthetician, Jasmine’s…

Breaking Through

When president Gwendolyn Tucker of RIX International first partnered with Communities Unlimited (CU) in early 2023, she…

From Side Jobs to Seven Figures

Several years ago, Juan Cervantes was out of work, out of options, and about to become a father. Coming out of the…

Entrepreneurship Team

Small business owners are some of our favorite people. Why? Because we’ve been where you are before. We know how it is. Tapping into our team’s experience and education to assist your business is something we all wished we’d had.

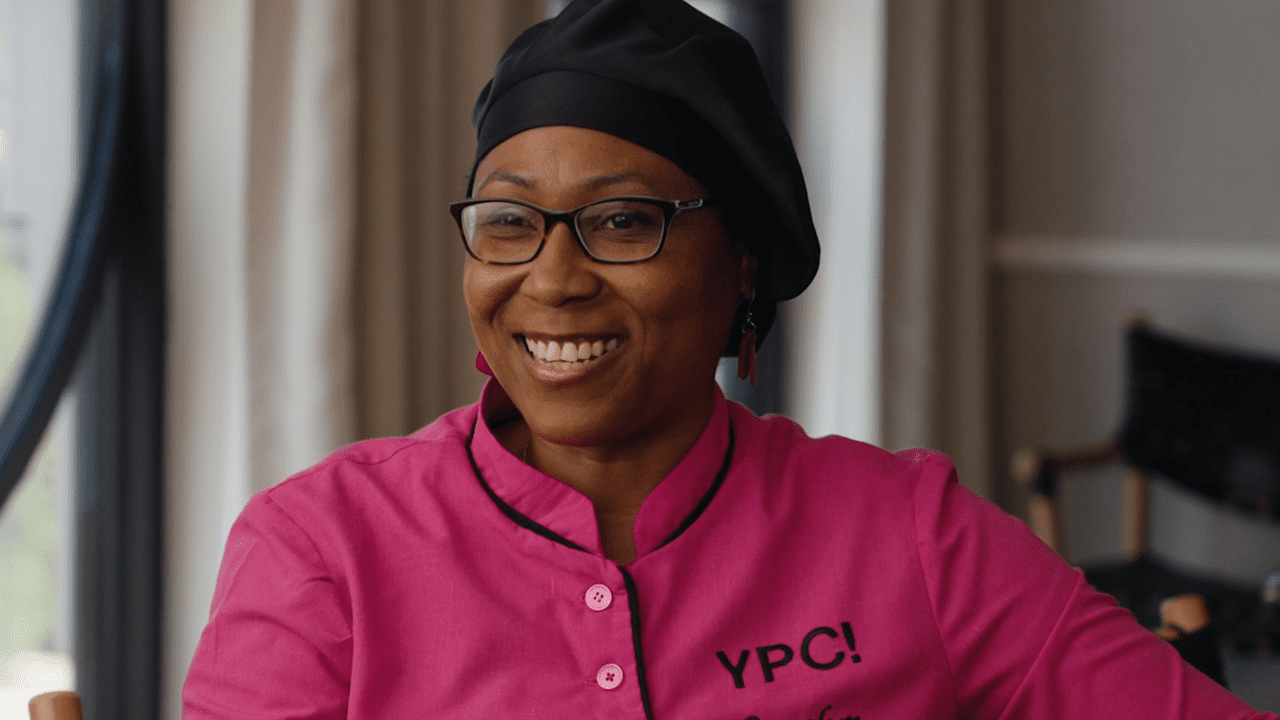

Cynthia Terry

Brian Wells

Dale Rutherford

Marnell Love

Rhett Douglas

James Custer

Tracy Cook

Trent Thomason

Katy Parrish

Latoyia Morgan

LaKetter Cannon

Sierra Polk

Director of Entrepreneurship

Cynthia Terry

Cynthia Terry, Director of Entrepreneurship, joined Communities Unlimited (CU) as a Management Consultant in 2004 and became the E-Team’s Director in 2016. She oversees fundraising, partner relationships, and daily operations, leading a team across CU’s seven-state service area.

The Entrepreneurship Program supports businesses at every stage, offering tailored one-on-one consulting, webinars, workshops, and an on-demand learning platform with 30+ courses. Its core focus is problem-solving growth challenges, developing strategic plans, and implementing solutions alongside business owners.

Cynthia has led key initiatives, including MEMShop, a retail popup model with the City of Memphis, and CU’s Wealth Builder program, helping entrepreneurs set realistic wealth-building goals. A lifelong small business advocate, she has also supported her husband’s business for 20 years. Cynthia holds an MBA and a Juris Doctorate from the University of Memphis and has been a licensed Tennessee attorney since 2003.

Phone:(479) 236-4631

Area Director

Brian Wells

Brian Wells, Area Director for Communities Unlimited (CU) works with rural communities, small businesses and entrepreneurs to solve problems and grow their business with in-depth consulting and innovative lending programs. He started his career as a command pilot in the United States Air Force. He then transitioned to being the Chief Financial Officer of a small firm with multiple business lines. Brian’s years of experience in different fields make him especially adept at finding solutions that fit his client’s needs. He has earned a Bachelor of Arts degree in Mathematics from the University of Arkansas at Fayetteville, a Bachelor of Business Administration degree in Accounting from the University of Arkansas at Little Rock and a Master of Business Administration in Finance from Indiana University Bloomington.

Phone:(501) 413-0535

Area Director

Dale Rutherford

Dale Rutherford is based in Little Rock, Arkansas. He started as Senior Management Consultant for Communities Unlimited (CU) position in March 2021. He then started working as a Special Projects Coordinator and in 2023 was promoted to Area Director. Dale works with clients to develop financial models and budgets for their existing or conceptual business ideas. Dale conducts assessments with clients to scope the type of their needs and helps them identify problems and develop plans to achieve their goals and objectives. Aside from being a published author, Dale holds several certifications, including the Lean Six Sigma Black Belt. Dale also has an MBA and a BS in Management from Henderson State University.

Phone:(479) 502-4698

Area Director

Marnell Love

Marnell Love, Area Director based in Memphis, Tennessee, began working with Communities Unlimited (CU) in 2020. He works daily to provide one-on-one assistance to small business owners and entrepreneurs to guide them in building, growing, and sustaining their businesses.

In addition to assisting small business owners and entrepreneurs, Marnell serves as a chaplain for the Sardis Fire Department in Sardis, Mississippi, providing care and counseling to firefighters, their families and victims of fires or accidents. He is a member of The Federation of Fire Chaplains. He also serves as a chaplain for hospital patients and those in palliative care. His education includes a Bachelor of Science degree in Accounting and Business Management, a Master of Business Administration in Finance, a Master of Science in Industrial Management and a Doctor of Education in Management and Employee Training Practices internationally.

Phone:(901) 412-0168

Senior Management Consultant

Rhett Douglas

Rhett Douglas, a Senior Management Consultant located in Memphis, Tennessee, joined Communities Unlimited (CU) in October 2020. He works with small businesses and entrepreneurs to prepare financial and operational plans for clients, conduct webinars on digital marketing and corporate structure, and assess small businesses for loan readiness.

Rhett comes from a business background, having successfully launched, and promoted two new franchise concepts in Collierville, Tennessee. He has a Bachelor of Arts degree in Theatre Concentration with a minor in Business from Harding University in Searcy, Arkansas. He has a Master of Business Administration in Sales-Marketing from Christian Brothers University in Memphis, Tennessee.

Phone:(901) 486-8817

Senior Management Consultant

James Custer

James Custer, Senior Management Consultant, joined Communities Unlimited (CU) in November 2023. James provides consulting services to the most challenging cases in time-sensitive situations and manages special projects for the Entrepreneurship Team. He works with business owners to develop relationships and assist them in areas where they need extra support, such as finance and business skills, delivering one-on-one management consulting to help businesses achieve their goals. Additionally, James develops and implements new hire training material and a QA/QC program.

James started out at CU as a Management Consultant for the Entrepreneurship Team. He was promoted to his current position in August 2024. Before joining CU, James was the Owner and Manager of Custer Construction Services. He has a Bachelor’s in Business Administration from West Texas A&M University. James lives in Amarillo, Texas.

Phone:(806) 341-0228

Management Consultant

Tracy Cook

Tracy Cook came to Communities Unlimited (CU) in May of 2022 as a Management Consultant. He works with small businesses to identify business problems and assists clients with the best course of action to guide their business in the right direction. He builds relationships with community leaders and other members of the community to educate them about the tools CU offers. He guides existing and potential business owners with funding and training opportunities to maintain their businesses and helps them to identify potential business problems and determine the best course of action.

Tracy has a Master of Business Education from the University of Arkansas at Little Rock.

Phone:(479) 790-8989

Management Consultant

Trent Thomason

Trent Thomason, MBA, joined the Communities Unlimited (CU) team in January 2023 as a Management Consultant. Trent helps small businesses identify potential issues and determine the best course of action. He builds relationships with clients, community leaders, and other community members to educate them on the tools CU offers. He helps businesses with funding and training opportunities.

He has more than a decade of experience as an entrepreneur, successfully launching Fit Camp Austin and the Enlightened Eating seminars, featured on NBC, Mind Body Green, and UT television. Trent is well traveled, versed in Mandarin, and able to provide clients of all backgrounds with robust, transformational consulting services, training, and technical assistance. Before starting CU, Trent worked as an Event Logistics and Tour Manager for Aardvark Mobile Tours, Lime Media. Trent has a Master of Business Administration in Finance from the University of Texas Permian Basin in Odessa, Texas.

Phone:(479) 409-4890

Broadband Technical Assistance Provider

Katy Parrish

Katy Parrish, Broadband Technical Assistance Provider, joined Communities Unlimited (CU) in August 2020. With a background in marketing and community outreach, she began her time at CU as a Management Consultant on the Entrepreneurship Team. After nearly five years in that role, she transitioned to the Broadband Team.

As a BTAP, Katy supports communities across CU’s seven-state footprint, helping them plan for broadband expansion. She provides education, addresses connectivity challenges, and builds local partnerships to empower residents to advocate for better internet access and adoption.

Katy holds a Bachelor of Business Administration from Texas Tech University and a Master of Business Administration with a concentration in International Business from Louisiana State University in Shreveport.

Phone:(479) 530-4756

Training Coordinator

Latoyia Morgan

Latoyia Morgan, Training Coordinator, joined Communities Unlimited (CU) in September of 2021. Latoyia works alongside business management consultants to develop course content. She also coordinates and facilitates training and other events and assists in providing advice and services to business clients.

Latoyia has a previous background in training. Latoyia received her MBA in Human Resources from the University of Phoenix-online. Before coming to CU, she served as a Training Coordinator for Agape Child and Family Services in Memphis.

Phone:(901) 450-9339

Management Consultant

LaKetter Cannon

LaKetter Cannon started Communities Unlimited (CU) as a Management Consultant in November of 2022. She assists aspiring and existing business owners in starting and growing their business. LaKetter helps them with business plans and financial forecasts.

LaKetter has been a Diversion and Inclusion Specialist for the United States Army Joint Forces in Jackson, Mississippi, since 2021. She has an MBA from William Carey College in Hattiesburg, Mississippi.

Phone:(479) 445-3748

Management Consultant

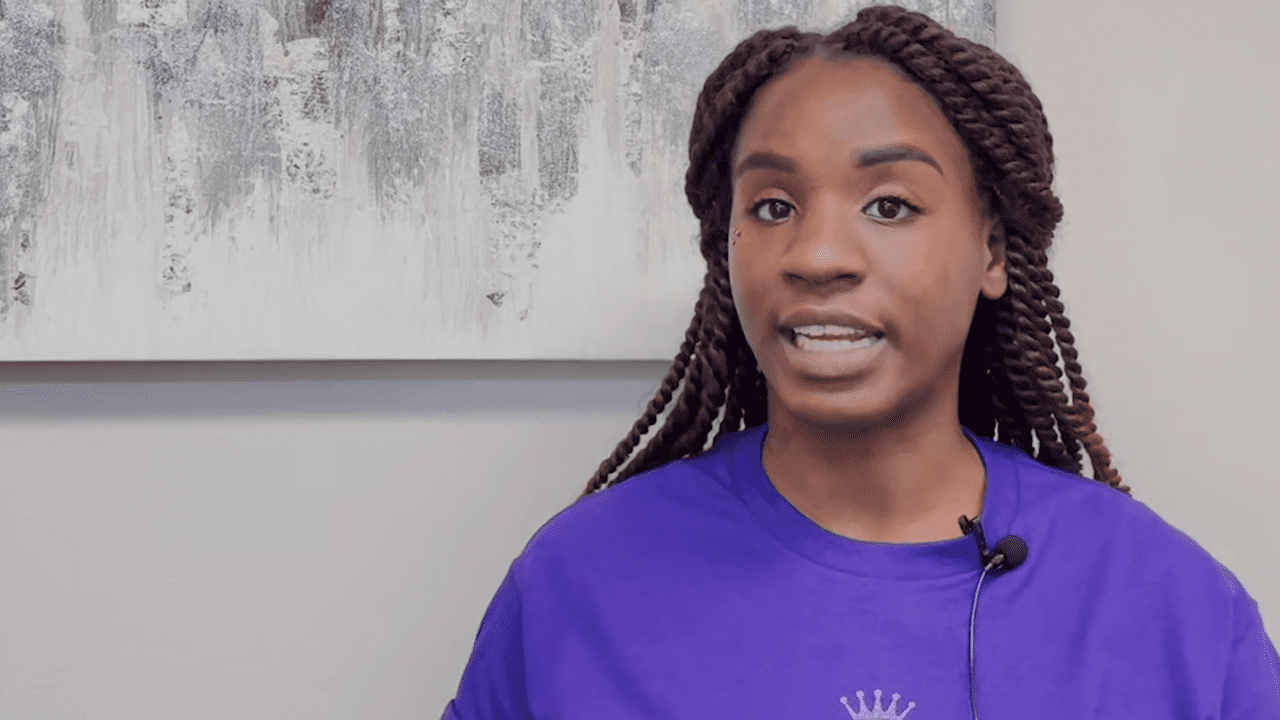

Sierra Polk

Sierra Polk joined Communities Unlimited (CU) in May 2023. She is a Management Consultant for the Entrepreneurship Team. Sierra works with business owners to develop relationships and work with them in areas that they need extra assistance. She develops relationships with potential clients and assists them in needs such as finance and business skills. She delivers one-on-one management consulting to help businesses with their goals.

Before coming to CU, Sierra was the Chief of Events, Engagement, & Programs for Precipice IP, PLLC Technology Law Firm. Sierra has a Bachelor of Science in Accounting from the University of Maryland Eastern Shore. Sierra lives in Bentonville, Arkansas, and works in the NWA area.

Phone:(501) 554-5873