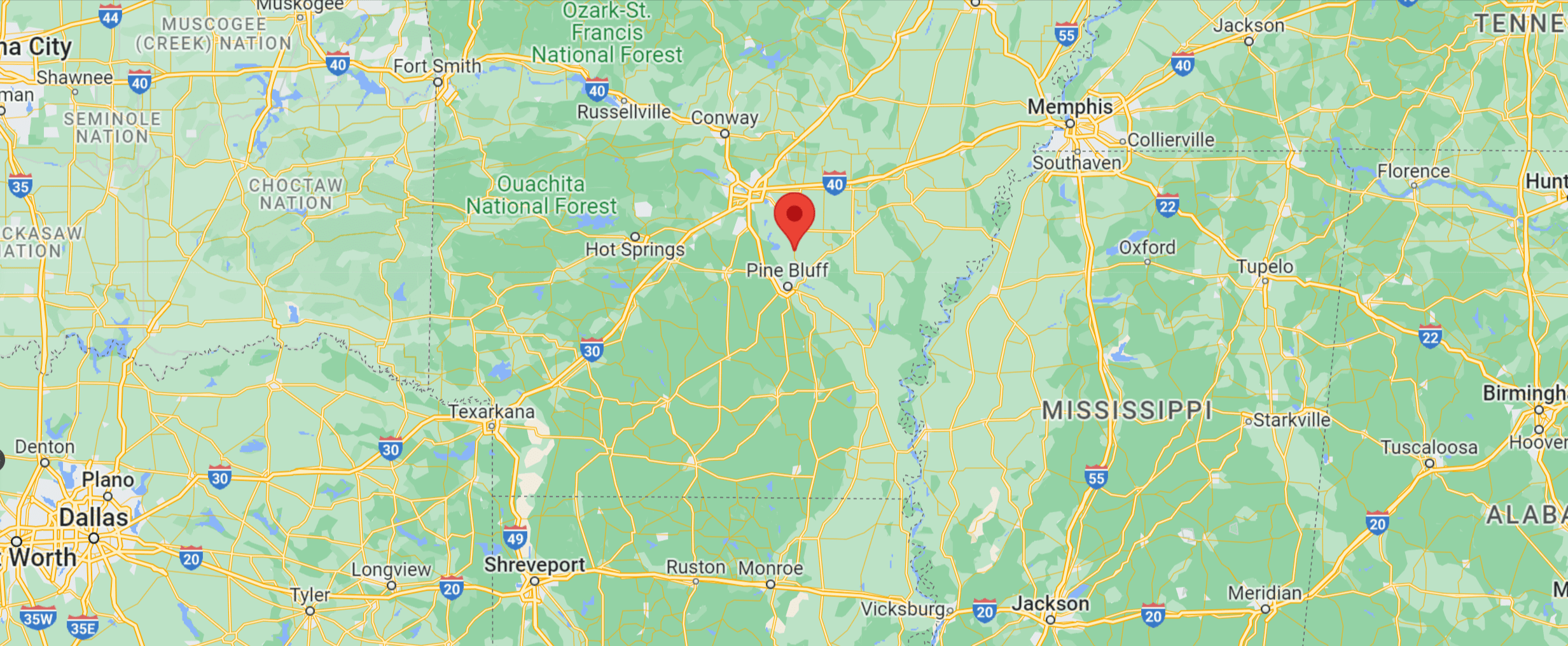

Jefferson County, Arkansas, is located in an area known as the Arkansas Delta. Jefferson County consists of five cities, with Pine Bluff being the largest. The Wright-Pastoria Water Association is located in rural Jefferson County, covers a large area geographically, and serves the communities of Wright, Pastoria, Sherrill, and Tucker. Many of the customers within the service area are low-income or retired households.

The Wright-Pastoria Water Association was incorporated in May 1979 to provide safe drinking water for the communities of Wright and Pastoria in Jefferson County, Arkansas. At its largest, Wright-Pastoria has served over 500 customers.

The water association’s mission is to provide safe, high-quality water service to the community while maintaining a standard of excellence in customer service and environmental conservation.

In 2016, the system took a hit during a flood that left the community uninhabitable. Around forty customers along Maynard Road lost their homes to flood waters and were not permitted to return to the area. Several farms in the area were also affected, and farm production has gone out of business recently.

The Arkansas Division of Natural Resources has required Wright-Pastoria to undergo a regionalization for funding infrastructure improvements due to a feasibility study conducted by Hawkins Weir Engineering in October 2022. To do this, the Wright-Pastoria Water Association will sell its water assets to the Grand Prairie Regional Distribution District (GPRWDD).

In July 2023, Wright-Pastoria Water Association started working with the Communities Unlimited (CU) Lending Team on an assessment and recommendation plan to move forward with the regionalization. The Grand Prairie General Manager signed the letter on July 17, 2023. The Arkansas Natural Resources Commission agreed to pay off Wright-Pastoria’s debt. The debt relief will bring about the regionalization of the water systems, and the Grand Prairie Regional Water District will absorb the Wright-Pastoria Water Association.

Communities Unlimited Arkansas State Coordinator for Environmental Services, Brad Jarrett, said, “The Wright-Pastoria Water Association has faced many challenges, from water quality operations to management and finances. The board of directors of the Wright-Pastoria Water Association has taken the necessary steps to regionalization by agreeing to have Grand Prairie Water Distribution District manage the water system that will provide adequate drinking water to its customers that are located throughout three rural incorporated communities that are located in a persistent poverty county”.

The system began working with the Low-Income Water Assistance Program (LIWAP), and the Wright-Pastoria Board voted to adjust and adopt new rates, service fees, and policies. With the new rates, Wright-Pastoria will be able to cover the CU debt during the life of the loan.

Dianne Aiken has served on the board and worked at the Wright-Pastoria Water Association for several years and is grateful for Communities Unlimited. “They have seen us through thick and thin,” Dianne said.

“This has been one of the biggest projects I’ve participated in since joining CU. The Wright-Pastoria and Grand Prairie staff contributed so much to its success. I appreciate the work that everyone contributed in getting this done.”

— Chris Ranniger, Small Business and Environmental Loan Officer

Once the regionalization is complete, citizens will benefit by having a sustainable water system that provides adequate drinking water and knowledgeable staff and will achieve compliance with the Arkansas Department of Health drinking water regulations. The emergency backup source that GPRWDD provided will create resiliency to the water system and adequately address emergency preparedness and response to maintain sustainability.