Choosing to start a small business venture can be a rewarding endeavor, offering a path to creating wealth, personal satisfaction, and a legacy for the next generation of the family. However, it’s also a journey fraught with challenges, and pitfalls. Understanding these challenges is crucial to navigating the path to success. This article will highlight key issues that entrepreneurs should consider when starting a small business.

Freedom Is an Illusion

When asked why they want to start their own business, many would-be entrepreneurs respond with “I want to have more freedom in setting my schedule and more time for my family.”

Unfortunately, such expectations are unrealistic for the vast majority of small business models. Unless you stumble into a unicorn business or acquire a goose that lays golden eggs, a successful small business requires many long hours, weeks, months, and years of hard work. Realistically, small business owners can expect to work 10-12+ hours a day, seven days a week while they are trying to launch, scale, and grow a business venture.

Smaller Than a Breadbox, or Larger Than the Empire State Building

The first and arguably most fundamental mistake first-time business owners make when launching a new venture is doing so without a clearly defined, and validated business model. Validation through a feasibility assessment supported by due diligence should answer questions such as;

- Is the product/service well defined and meets a REAL need in the marketplace?

- How much will it cost to produce/deliver the product or service?

- How much can I reasonably expect to sell the product or service?

- How great is the demand?

- How much capital will I need to start and sustain the business until sales reach a level that generates profit, and the cash starts coming in from sales

- What are the risk factors that impact the successful launch and operation of the business?

These are just a few of the fundamental questions that must be answered to define a viable business model.

Know When to Hold Them, Know When to Fold Them…

In Kenny Roger’s song, The Gambler, the refrain goes, “You’ve got to know when to hold them. Know when to fold them. Know when to walk away. Know when to run.” Every entrepreneur should take these words to heart when assessing whether or not to invest in a new business venture.

The guiding light for the development of a viable small business model should be the alignment of the business goals and objectives with the owners’ personal wealth goals. A successful entrepreneur has a clear idea of the level of profitability and free cash flow the business needs to generate to support their family and allow them to accrue wealth. If the feasibility assessment can not provide a reasonable expectation that the business venture can support your wealth goals, you have two basic options, 1) revise the business model and reassess its viability or, 2) pass on that idea and seek a more promising business idea.

The Fish in The Fishbowl

There is an old analogy that states, “… a goldfish will grow to the size of the fishbowl.” This is an important consideration when planning a new business venture. Typically, small businesses are heavily dependent on a marketplace that’s limited to a relatively small geographic area. Therefore, the business model must define the serviceable market area and establish realistic estimates of the market potential to support the idealized business. The output is a reasonable expectation of how much revenue, profit, and free cash flow the business can generate to meet the financial needs of the business owner.

Another often neglected element of the market analysis is the due diligence put forth to identify and assess any competition the new business must compete to establish a beachhead market. The worst assumption made in analyzing competition is the false assumption of, “We don’t have any competition.”

Everyone has competition, even if the choice is to not purchase the product or service at all.

Don’t Bottom Out When You Hit a Speed Bump

Cash is a tool common to all businesses. Just as a carpenter can’t build a house without a hammer, ruler, saw, etc. Likewise, businesses must have sufficient capital, in the right amount, at the right time to function and be successful.

A study conducted by the J. P. Morgan Institute, of nearly 600,000 small businesses across the country revealed that more than half had less than one month of working capital. Twenty-five percent had less than 15 days of cash reserve. What would happen to your business if you experienced a disruption of more than a few days?

The single biggest contributor to small business failures in the country is launching a small business under-capitalized. It’s essential to accurately estimate startup costs, and operational expenses, and to project the revenue needed to break even and eventually turn a profit. Additionally, having a financial cushion for unexpected costs can be the difference between survival and failure during tough times.

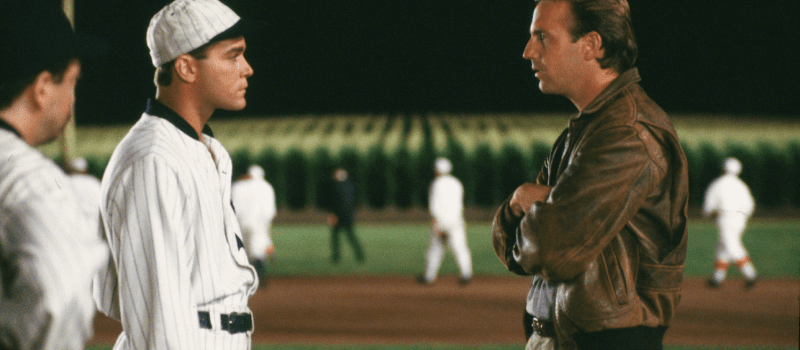

If You Build It, They Will Come – Or Not

In the 1989 movie, Field of Dreams, Keven Costner staked everything on a ghostly encounter in which he was told, “… If you build it, they will come.” The plot makes for an interesting movie, but in reality, “If I build it, they will come,” is not a viable substitution for a well-thought-out marketing strategy.

In today’s digital age, neglecting your online presence can be a fatal mistake. A well-designed website and active social media profiles can significantly boost your visibility, credibility, and customer engagement. They also provide platforms for online marketing and sales, which can be cost-effective ways to reach a wider audience and generate revenue.

What Does the Customer Know About Making Widgets

Managing customer expectations is one of the most important elements of sales and marketing. Perception is stronger than reality when it comes to how customers view your product, quality, features, and service. Therefore, ignoring customer feedback is a fatal mistake made by many failed businesses.

Customers are the lifeblood of any business, and their feedback provides valuable insights into your product’s strengths and weaknesses. By listening to and acting on customer feedback, you can improve your product or service offering, enhance customer satisfaction, and build loyalty, all of which can drive business growth.

One of These Days, I’ll Get Around to That

“Working on the business rather than working in the business” is a concept popularized by Michael Gerber in his book “The E-Myth Revisited.” It’s a principle that encourages business owners to shift their perspective from being a worker in their business to being a manager or owner who oversees and improves the business. More often than not, small business owners get overwhelmed with keeping the doors open, the lights on, and keeping the shelves stocked that they tend to neglect another critical element of the business – managing the business.

The key to success is in finding a balance between the two. A business owner needs to ensure the daily operations are running smoothly (working in the business) but should schedule time for reviewing business operations, planning, and development (working on the business) to ensure the business can grow and thrive in the long term.

Surviving In a VUCA World

VUCA stands for Volatility, Uncertainty, Complexity, and Ambiguity. It’s a concept that originated in the U.S. military to describe the chaotic, turbulent, and rapidly changing conditions that can occur in warfare, but it has since been adopted by the business world to describe similar conditions in the rapidly changing business environment.

For a business to survive and flourish in a VUCA marketplace, entrepreneurs need to adopt an agile mindset, expand their knowledge, develop new skills, and learn to lead employees to adapt to ever-changing customer demands and competition.

Neglecting Legal and Regulatory Requirements

Finally, ignoring legal and regulatory requirements can lead to costly penalties and damage to your business’s reputation. It’s crucial to understand the licenses, permits, and regulations applicable to your business and ensure compliance. Consulting with a business attorney can help you navigate these complexities.

Starting a small business can be a rewarding journey, but it’s not without its challenges. By avoiding these common pitfalls, you can increase your chances of success and enjoy the fruits of your hard work and dedication. Remember, every successful business started as a small idea. With careful planning, diligent execution, and a customer-focused approach, your small business can grow into a thriving enterprise.

So, Where Do I Go From Here?

If you would like to discuss ways to improve your business to take advantage of growth opportunities, improve profitability, or how you can more effectively generate wealth from your business, feel free to contact the Entrepreneurship Team. If you would like to schedule a no-cost, no-obligation consultation with one of our consultants, visit our Entrepreneurship Team page

Dale Rutherford

Dale Rutherford is a Senior Management Consultant at Communities Unlimited. Dale works with clients to develop financial models and budgets for their existing or conceptual business ideas. Dale conducts assessments with clients to scope the type of their needs and helps them identify problems and develop plans to achieve their goals and objectives. Reach Dale at dale.rutherford@communitiesu.org