Starting a small business is a unique decision that varies among owners, each with their own personal reasons. Understanding their true motivation for starting their venture often requires asking several questions, but ultimately it comes down to generating income and creating wealth.

In that respect, entrepreneurship is a powerful tool for creating wealth, as it offers the potential for unlimited wealth creation and enables individuals some degree of autonomy and self-determination over their lives. This article will delve into the fundamental principles that drive wealth creation through entrepreneurship.

Paths to Wealth Creation

Creating wealth should be viewed as a lifelong journey rather than a life event, which can be achieved by following either of four main pathways. These paths include inheriting wealth, saving and investing, pursuing a high-paying career, or entrepreneurship. Each path offers its own unique opportunities and challenges that affect the amount of wealth accumulated and the time it takes to do so.

Entrepreneurship is considered one of the most potent paths to wealth creation. It is open to individuals of all ages, educational backgrounds, and demographics. The value of a business can increase significantly over time, leading to the accumulation of substantial wealth. However, entrepreneurship also carries risks, such as financial risk and the possibility of business failure.

Wealth Creation – Begin with the End in Mind

Most books and articles on entrepreneurship will tell you that the first step in entrepreneurship is idea generation. However, for anyone considering starting a new business venture, a wise first step should involve thinking through and defining their wealth goals and objectives.

As an entrepreneur, creating wealth means building a profitable business that generates profits for the owner and increases in value over time. This can be achieved through ongoing profits and selling the business or shares for a substantial profit. It’s essential to define your expectations for the business, such as whether it will be a side hustle or full-time, how much income is needed to support your personal budget, and if it will create wealth beyond living expenses for future investments like buying a house, funding retirement, or paying for your children’s college expenses.

Once you have defined wealth goals, you now have a benchmark for assessing the economic viability of the new business venture.

Idea Generation and Validation

Creating a viable business idea requires more than a random thought or just turning a hobby into a business. It involves thoroughly identifying a market gap and understanding potential customers’ needs and preferences. The biggest mistake a new business owner can make is trying to sell a product or service without truly understanding the target market’s needs, preferences, and willingness to buy.

Once you have an idea, you must validate it. Validation requires market research to ensure sufficient demand for your product or service to generate satisfactory revenue and profit to support the entrepreneur’s wealth goals and objectives.

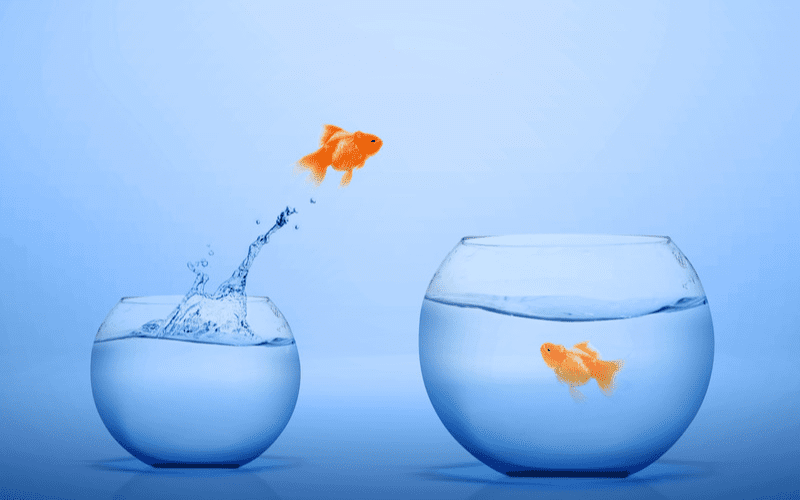

Don’t Become a Victim of, The Fish in the Fishbowl Phenomenon.

Imagine a small fish in a fishbowl. The fishbowl represents the market in which a small business operates, and the fish symbolizes the small business itself. The water within the bowl signifies the resources available to the business, including capital, talent, and customers – all constrained by the fishbowl’s size.

Interestingly, the fish doesn’t realize that he’s in a fishbowl. To the fish, looking through the glass, the whole room is his environment, when in reality, his world is defined by the confines of the fishbowl. Just as a fish can only grow as large as its fishbowl allows, similarly, a small business can only sell as much as its market demands. For the fish to grow beyond the limits of its bowl, it may need a larger environment to thrive. Likewise, a business may need to consider whether the proposed business idea is truly limited to a local market or whether there are prospects of new markets or diversifying its offerings to continue growing.

The fish in a fishbowl analogy vividly illustrates the challenges and opportunities an entrepreneur should consider before launching a new business. Like the fish, businesses must adapt to their environment, manage resources wisely, and deal with the implications of market constraints. By understanding the fishbowl phenomenon, would-be business owners can better assess the viability of their business ideas.

Aligning Business Goals with Personal Wealth Goals

The vast majority of micro-small business owners operate without any form of business plan; many do so without the benefit of well-prepared financial projections. Some take pride and even boast of “flying by the seat of their pants.” Unfortunately, the statistics related to small business failure suggest that a well-structured business plan is essential to long-term business success and sustainability.

However, for the entrepreneur to create wealth from the business enterprise, the business plan must be aligned with the owner’s personal wealth goals and objectives. The plan outlines your business goals, strategies for achieving them, and the resources required. A robust business plan includes market analysis, financial projections, and an operational plan.

Balancing Business and Personal Financial Health

An essential aspect of achieving financial success through entrepreneurship is ensuring the business can scale and grow beyond providing just enough income to support the owner’s family. The growth and scaling of any business should result from proper planning, including a capital budgeting plan. Several small businesses become insolvent every year when they experience unplanned or unexpected growth. My father once told me, “… an opportunity is only an opportunity if you are in a position to take advantage of it.”

Obtaining capital is crucial for any business to reach its growth objectives. Capital readiness involves planning and addressing the business’s and the owner’s financial health. If the owner’s financial health is unstable, it can negatively affect the business’s financial health and vice versa. Ultimately, obtaining a business loan results from careful capital planning and management to achieve the desired growth and success.