Expanding economic opportunities for people and communities

LENDING

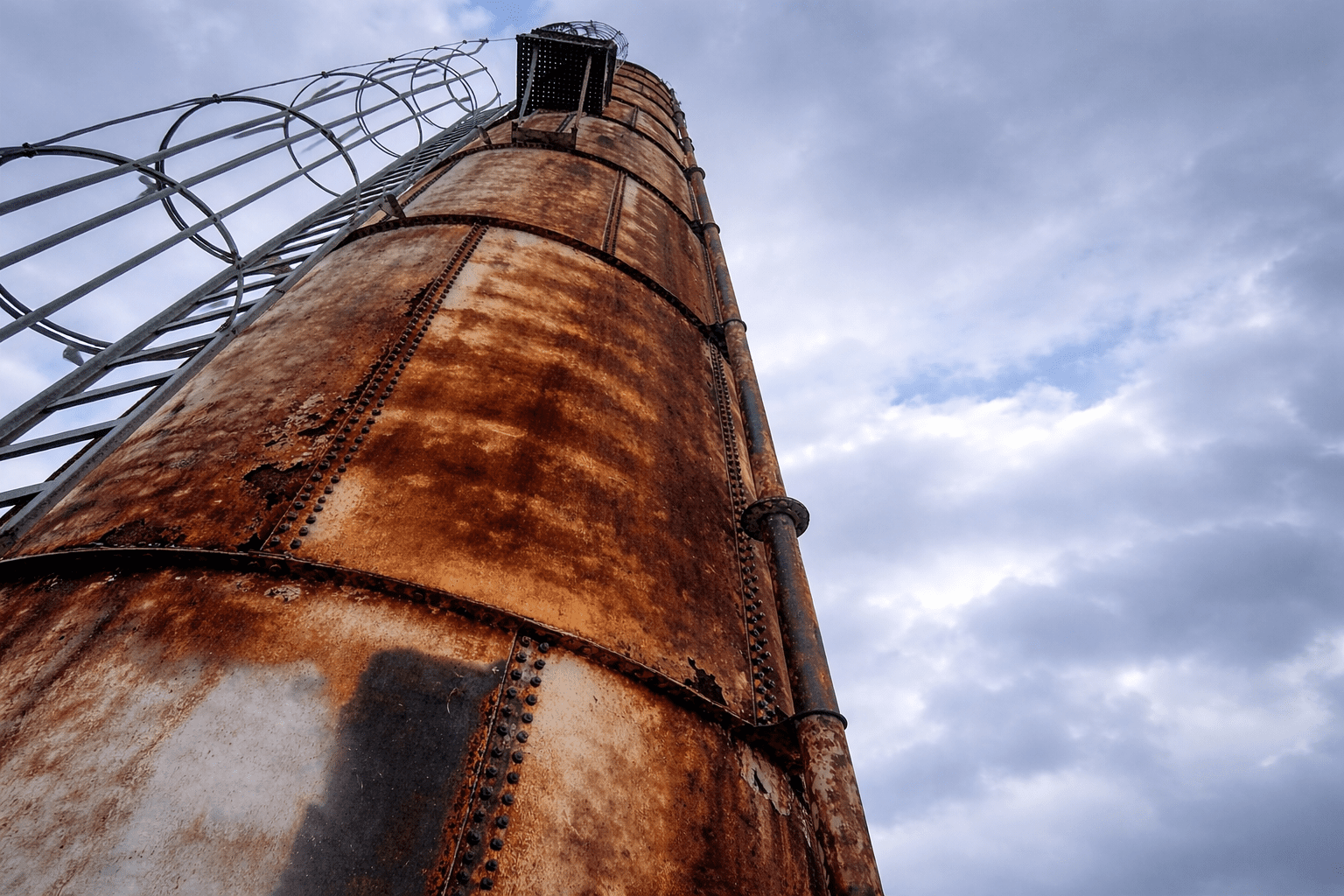

Water

Entrepreneurs

Housing

Helping rural communities meet regulations, improve system quality and security, and expand service. Our loans support rural systems who deliver clean, safe water to the people who rely on them.

Helping entrepreneurs grow by supporting product development, hiring, and expansion. Communities Unlimited provides loans to small businesses to fuel growth, create jobs, and boost local economies.

Communities Unlimited’s Home Improvement Loan program helps residents in select counties in Arkansas and Texas access funding for essential home repairs like roof leaks, flooring, and HVAC systems.

At Communities Unlimited, we’re here to help rural families, small business owners, and communities get the funding they need to grow and thrive. We offer affordable loans to support:

-

Small businesses and local entrepreneurs looking to start or grow

-

Homeowners who need to make important repairs or improvements

-

Communities working to upgrade water and wastewater systems

We understand that access to funding can be a challenge in rural areas. That’s why we’re committed to filling the gap and making sure people have the support they need to build stronger businesses, safer homes, and healthier communities. With over $45 million in loans provided across 24 states, we’re proud to be a trusted partner in rural success.

Our lending program helps small business owners grow and create jobs, assists rural communities in financing critical water and wastewater system improvements, and provides homeowners with critical loans to improve their homes while avoiding predatory lending.

We’re on a mission to ensure that rural Americans have the capital they need to build sustainable businesses and resilient communities.

Communities Unlimited was certified as a Community Development Financial Institution (CDFI) in 2001.

LENDING STORIES

Growing Stronger

More than 20 years ago in Scott, a small suburb of Lafayette, Louisiana, a group of community members came together…

Building the Picture

Mississippi entrepreneurs Paul and Breanna Sweet didn’t just want a business. They wanted something lasting — a way to…

Modern Meters

In rural Perry County, Alabama, providing reliable drinking water requires more than operating pumps. The Perry County…

From Adversity to Comeback

By the time Michele Henegar first walked into the office at Siam Utility District, the problems were so deep that even…

Two Decades in the Making

When Board Chairman Fred Hammack looks back on Delaware County Rural Water District #12’s journey, one moment always…

Refusing to Quit

Thinking about regionalization for your rural water system? This video explains what regionalization means, why it…

Habit Shift

When Jennie Christopher began teaching behavioral science to college students, she never imagined it would lead her…

When Capital Meets Care

On a small piece of inherited land in Slaughter, a rural community in East Feliciana Parish in southeast Louisiana,…

Under Control

Across the U.S., alternative financing and entrepreneurship solutions are helping small business owners find new paths…

From Housing Work to a Lending Lifeline

When Susan Forte walked into a ribbon-cutting event in Pine Bluff, Arkansas earlier in 2025, she wasn’t there to…

Keeping Local Food Growing

When the Acadiana Growers Alliance (AGA) was founded in 2015, it grew from a simple belief: that everyone in southern…

Crisis Averted

When Leona Stephens thinks back on the past year, one sound stands out more than any other: the crack of…

Lending Team

Debra Leach

Jane Coffin

Michael Rivera

Chris Ranniger

Chris Tillman

Amber McClellan

Candence Brooks

Yessie Hernandez

Jesse Saldana

Alexandria Cordero

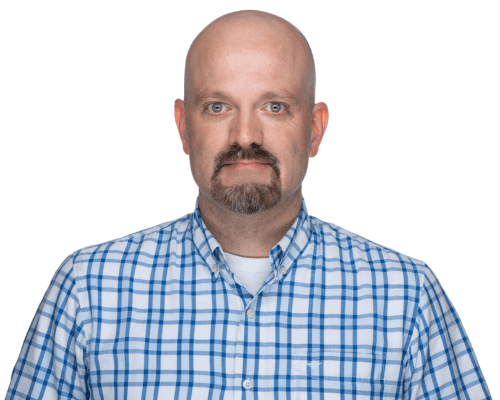

Area Director of Lending

Debra Leach

Debra Leach, Area Director of Lending, joined Communities Unlimited (CU) in May 2021.

She is responsible for originating quality loans through internal and external referral sources. She also develops strategies to market the bank’s SBA and small business grant programs to entrepreneurs with financing needs. She came to Communities Unlimited with a strong financial background, from her previous roles as a Vice President/Loan Manager for Arvest Bank as well as Vice President of Commercial lending for RCB Bank.

Debra has a BS in Business Administration, Marketing Management Orientation from Southwest Baptist University in Bolivar, Mo.

Phone:(405) 250-9316

Loan Operations Manager

Jane Coffin

Jane Coffin is the Loan Operations Manager for Lending for Communities Unlimited. She started CU in a Small Business Association (SBA) Payroll Protection role.

Jane has 16 years of nonprofit experience and brings her office management skills to her role as Loan Operations Manager. Her duties include post loan management, compliance, and collections. She is responsible for monitoring line filings, financial statements, and insurance compliance. She assists the Director of Lending in producing weekly, monthly, and quarterly reports. She has also increased the functionality of Communities Unlimited’s loan software. Jane monitors and reports on our current SBA profiles and assists in grant reporting and data management.

Phone:(479) 380-5097

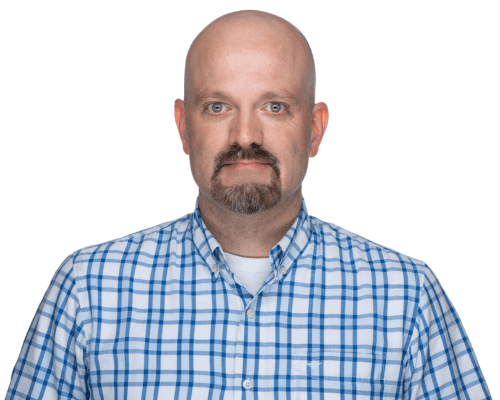

Director of Lending

Michael Rivera

Michael Rivera started Communities Unlimited (CU) as a Director of Nuestra Casa in April 2022. In January 2024, he was promoted to the Director of Lending. Michael provides leadership to a team of 7 employees. He handles the management of the loan process as well as Communities Unlimited’s Community Development Financial Institution (CDFI) program. The CDFI Program includes small business, consumer, and commercial portfolios with assets of $17 million.

Michael has a 15-year background in banking and finance. During his time as Director of Nuestra Casa, he led the Nuestra Casa program that offered small-dollar loans to people in the Colonias for home improvement projects.

He has an Associates of Arts Degree in Business Management and Marketing from Athens Technical College.

Phone:(870) 403-3285

Senior Economic Development Loan Officer

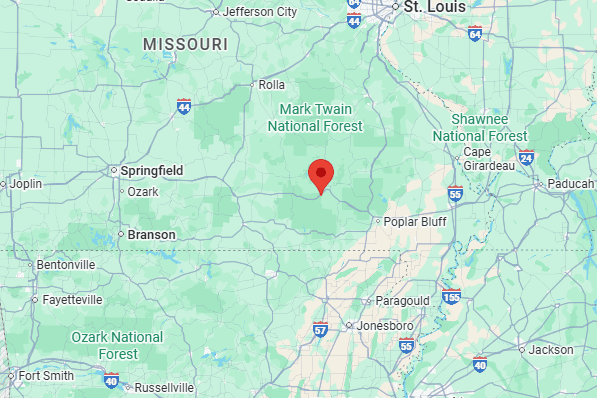

Chris Ranniger

Chris Ranniger is a Senior Economic Development Loan Officer for Communities Unlimited (CU). On top of commercial loans, Chris also handles CU’s infrastructure lending. He meets with borrowers to develop relationships, helps them get all accurate documents, and ensures they are properly prepared for the loan process. He guides clients through the loan process and works with the loan committee to ensure that everything is ready for loan closing.

Chris has a B.A. in Finance from Stephen F. Austin State University in Nacogdoches, Texas. Chris works out of CU’s East Texas office.

Phone:(936)404-4480

Economic Development Loan Officer

Chris Tillman

Chris Tillman joined Communities Unlimited (CU) in October 2021 as an Economic Development Loan Officer Small Business Development Lender.

He has an Associate of Arts in Business Administration from Mississippi Gulf Coast Community College and a Bachelor of Science in Business Administration from the University of Southern Mississippi. Chris has several years of experience in the loan, financial, and lending business.

Phone:(479) 380-5655

Loan Assistant

Amber McClellan

Amber McClellan, Program Assistant (Loan), originally came to Communities Unlimited in July 2018 as a Receptionist and moved up to Program Assistant in April 2019. In 2020, Amber became the Executive Assistant to the CEO and assisted with AHCC, Loan Closings, and more. She eventually moved into a full-time Loan Assistant position in 2022. In this role, Amber accepts and reviews new loan applications, answers client’s questions, files necessary paperwork, and performs other administrative duties.

Amber attended Northwest Arkansas Community College in Bentonville, Arkansas, and is a graduate of Farmington High School.

Phone:(479) 236-4291

Economic Development Loan Officer

Candence Brooks

Candence Brooks started at Communities Unlimited (CU) in September 2023 and is an Economic Development Loan Officer. Candence meets with borrowers to develop relationships, helps them get all accurate documents, and makes sure they are properly prepared for the loan process. She guides clients through the loan process and works with the loan committee to ensure that everything is ready for loan closing.

Before coming to CU, Candence worked as a Business Consultant for the A-State Small Business and Technology Development Center. Candence has a Bachelor of Science in Marketing and a Master of Business Administration from the University of Jonesboro.

Phone:(479) 595-5053

Loan Assistant

Yessie Hernandez

Yessie Hernandez started CU in September 2023 as a Program Assistant (Loan). Yessie assists the lending team by accepting and reviewing new loan applications, answering client questions, filing paperwork, and other administrative duties.

Yessie has an MBA in Business Administration and a BS in Business Administration from the University of Phoenix. Before coming to CU, Yessie worked as the owner and operator at her Mobile Notary Services business. Yessie assists the Lending Team with loan documents and loan closings.

Phone:(479) 856-4921

Consumer Loan Officer

Jesse Saldana

Jesse Saldana joined Communities Unlimited (CU) as the Consumer Loan Officer in December 2024. Jesse lives in Brownsville, TX, and brings almost 20 years of experience as a Personal Banker at Wells Fargo to the position.

Jesse manages consumer loans, assesses applicant eligibility, monitors payments, and ensures borrower satisfaction and timely repayment. He holds a Bachelor of Business Administration in Finance from Pan American University.

Phone:(956) 431-8848

Loan Officer

Alexandria Cordero

Alexandria Cordero joined Communities Unlimited (CU) as a Small Business and Environmental Lending Intern in January 2025, where she supported Senior Economic Development Loan Officer Chris Ranniger. In January 2026, she transitioned into a full-time role as a Loan Officer.

In her role, Alexandria works across both community infrastructure and small business lending. Alexandria holds a Bachelor’s degree in Banking from Stephen F. Austin State University and lives in Lufkin, Texas.

Phone:(956) 476-8833

In accordance with federal law and U.S. Department of the Treasury policy, this institution is prohibited from discriminating based on race, color, national origin, sex, age, or disability. Submit a complaint of discrimination, by mail to U.S. Department of the Treasury, Office of Civil Rights and Equal Employment Opportunity , 1500 Pennsylvania Ave. N.W., Washington, D.C. 20220, (202) 622-1160 (phone), (202) 622-0367 (fax), or email crcomplaints@treasury.gov (email).

Reasonable Modifications for Individuals with Disabilities

Reasonable modifications may be requested by emailing info@communitiesu.org or calling (479) 443-2700, or persons with speech or hearing impairment may call toll-free 1-800-877-0996 for service in English and Spanish.